RCEP, as the world's largest existing economic free trade area, has been attracting attention for its economic effects since it came into effect on January 1, 2022. Over the past year, the overall trade and investment in the RCEP region has grown rapidly, the regional industrial chain supply chain has shown strong resilience, and the initial release of economic growth dividends has helped regional economic and trade cooperation to become a new force driving global trade and investment growth under multiple crises.

Objectively speaking, RCEP has been in force for just over a year, and although it has had a positive impact on regional trade and investment, there is still room for further growth, which needs to be objectively assessed and viewed. As RCEP enters a new phase of full implementation, member countries should implement RCEP with high quality, jointly build an open and modernized international cooperation network of industrial supply chain, promote RCEP upgrading and expansion, and further stimulate the cooperation potential of RCEP.

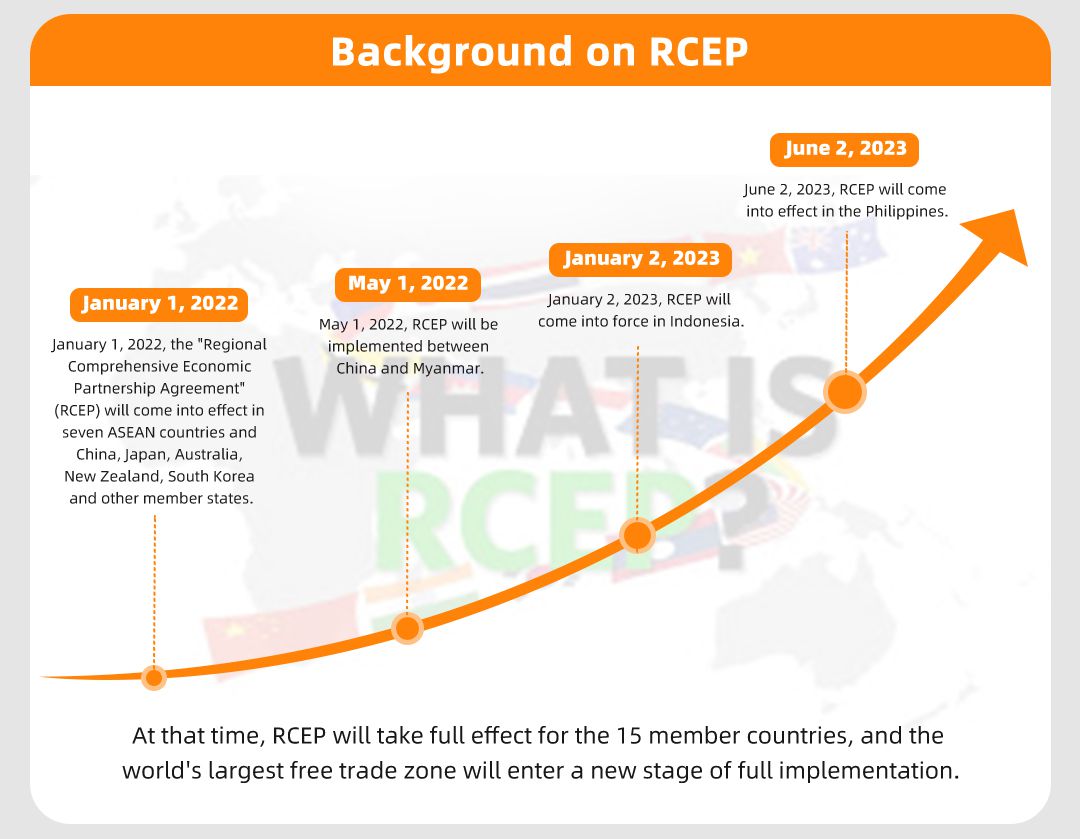

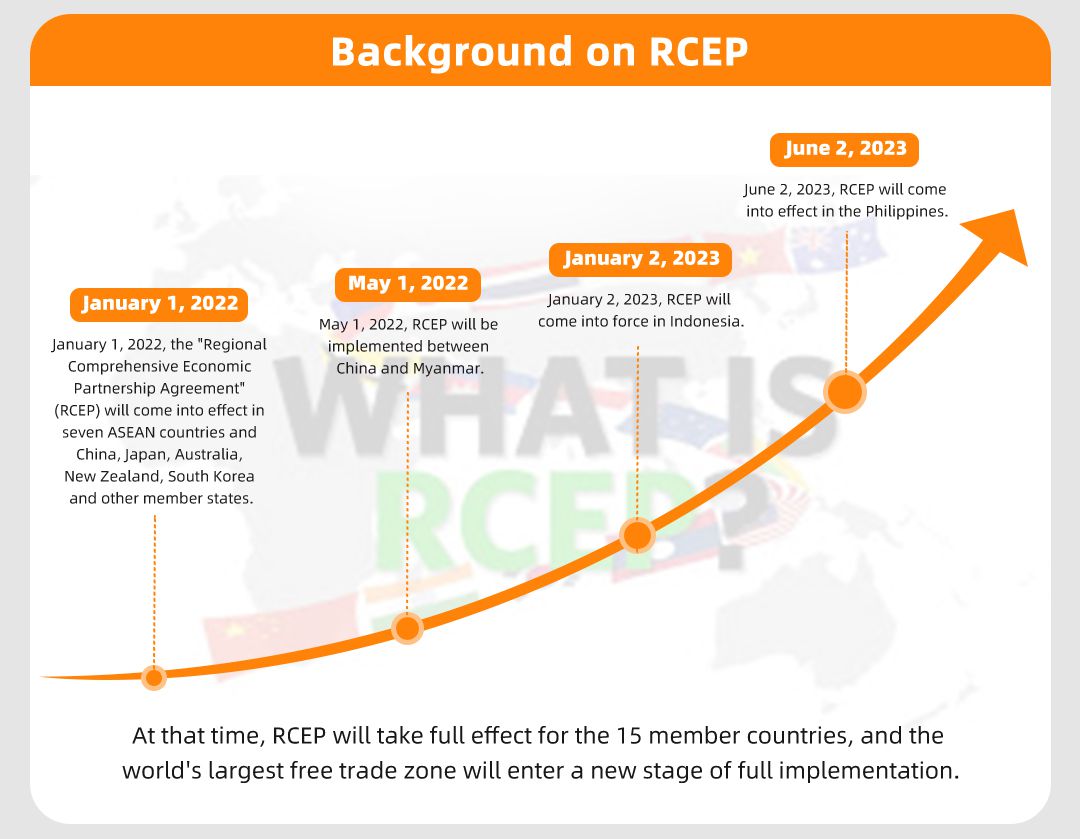

Background on RCEP

Since January 1, 2022, the Regional Comprehensive Economic Partnership (RCEP) has been implemented in seven ASEAN countries and member countries including China, Japan, Australia, New Zealand, and Korea.

The RCEP is implemented between China and Myanmar on May 1, 2022.

On January 2, 2023, RCEP will enter into force in Indonesia, and on June 2, it will enter into force in the Philippines. RCEP will enter into force for all 15 member countries, and the world's largest FTA will enter a new phase of full implementation.

RCEP, as the world's largest economic free trade area, has been in effect for one year, and the positive effects on regional trade and investment are gradually emerging.

Regional trade progress on the first anniversary of the entry into force of RCEP

Since 2022, the world economy has been suffering from a lack of recovery momentum and sluggish market demand due to a combination of factors such as the recurrence of the new crown epidemic and the escalation of geopolitical conflicts, further leading to a slowdown in the growth of international trade. According to a report released by the World Trade Organization (WTO) in April 2023, the volume of world trade in goods grew by only 2.7% in 2022, a decrease of 6.7 percentage points from 2021.

(1) Overall Progress of RCEP Regional Trade

Despite the increasing downward pressure on the international economy, since the RCEP came into effect in 2022, trade in goods between members in the region has become closer and maintained a better trade growth dynamics.

1. RCEP member countries maintain good trade growth dynamics

Since 2022, RCEP member countries have maintained good growth dynamics for global trade in goods in general, while showing some divergence. Indonesia, Malaysia and Australia all maintain growth rates of around 20% or higher, Singapore, the Philippines, Korea and Thailand maintain growth rates of 10%-15%, and Vietnam, New Zealand, Japan and China maintain growth rates of around 5%-10% for global trade in goods.

2. RCEP regional trade in intermediate goods has been growing steadily

In 2021, intra-RCEP trade in intermediate goods will reach US$3.7 trillion, accounting for 65.4% of total intra-RCEP trade in goods and 47.0% of total global trade in intermediate goods by RCEP member countries.

(2) Progress of trade in goods between China and RCEP member countries

According to the Global Trade Watch database, China's total trade in goods to other RCEP members in 2022 is US$ 194.663 billion.

The year-on-year increase of 4.4% contributed to a 1.4 percentage point increase in China's total foreign trade, accounting for 30.8% of China's total foreign trade.

1. China has active trade in goods with other RCEP members

In the first year since the RCEP came into effect, ASEAN has further consolidated its position as China's number one trading partner, and China's bilateral trade with ASEAN member countries has been active, with the overall trade in goods with ASEAN continuing to lead the RCEP region.

In 2022, China's total trade in goods with the ten ASEAN countries will reach US$979.34 billion, up 11.6% year-on-year, exceeding China's foreign trade growth rate by 7 percentage points and accounting for 50.3% of China's total trade with other RCEP members.

2. The scale of trade in electrical and mechanical products, light industrial products, as well as agricultural products and energy resources continues to expand

Electromechanical products, plastic products, iron and steel products, and furniture are the main export products of China to the RCEP region.

The first anniversary of the RCEP regional investment progress

In the second quarter of 2022, global FDI inflows and outflows decreased by 41.2% and 10.4%, respectively, compared to the first quarter, and in the third quarter, global FDI inflows and outflows fell further to 40.8%, due to multiple factors, including the Ukraine crisis, continued Fed rate hikes, food and energy supply constraints, and geopolitical turmoil. Global FDI outflows fell further to 40.8% in the third quarter.

(1) Overall progress of RCEP regional investment

Despite the complex and challenging international environment, the entry into force of RCEP has added confidence and momentum to regional economic development and increased the attractiveness of the RCEP region for FDI, with significant progress in investment in the RCEP region in 2022.

1. Most RCEP member countries show an upward trend in FDI utilization

According to official country data, most RCEP members' FDI utilization is still growing rapidly and showing a positive upward trend despite the downward trend of global FDI in 2022.

In terms of sectoral distribution, the RCEP region in 2022 will attract greenfield investments mainly in renewable energy, metals, real estate, andCommunications, logistics and warehousing, electronic components, software and IT services, coal/oil and gas, business services, financial services, and more.

From outside the region, the US and European countries (EU+UK) have been active in greenfield investment in the RCEP region.

From an intra-regional perspective, non-ASEAN members and Singapore are the main countries making greenfield investments in the RCEP region.

2. RCEP region as a whole attracts strong growth in greenfield investment

In 2022, the total number and value of greenfield investment projects attracted by RCEP member countries will generally rebound compared to 2021.

(2) Progress of Investment Cooperation between China and RCEP Member Countries

Since the entry into force of RCEP, not only have Chinese governments at all levels actively expanded reform and opening up in line with the commitments of the agreement, creating favorable conditions for expanding investment cooperation with other RCEP member countries, but also ASEAN countries and other RCEP member countries have actively taken advantage of the opportunities brought by RCEP to increase domestic reform efforts and further optimize the business environment, resulting in positive progress in investment cooperation between China and other RCEP member countries. China's investment cooperation with other RCEP member countries has made positive progress.

1. Korea, Japan, Singapore and other RCEP member countries to China's rapid growth in investment

According to the survey, 78% of RCEP member companies have plans to expand their chains in China, higher than the average of 70% in other markets.

2. China's investment in ASEAN and other RCEP member countries has become more active

Since the effective implementation of RCEP, Chinese enterprises' willingness to invest in ASEAN and other RCEP member countries has further increased. According to the Ministry of Commerce of China, China's non-financial direct investment in other RCEP member countries in 2022 was US$17.96 billion, up 18.9% year-on-year.

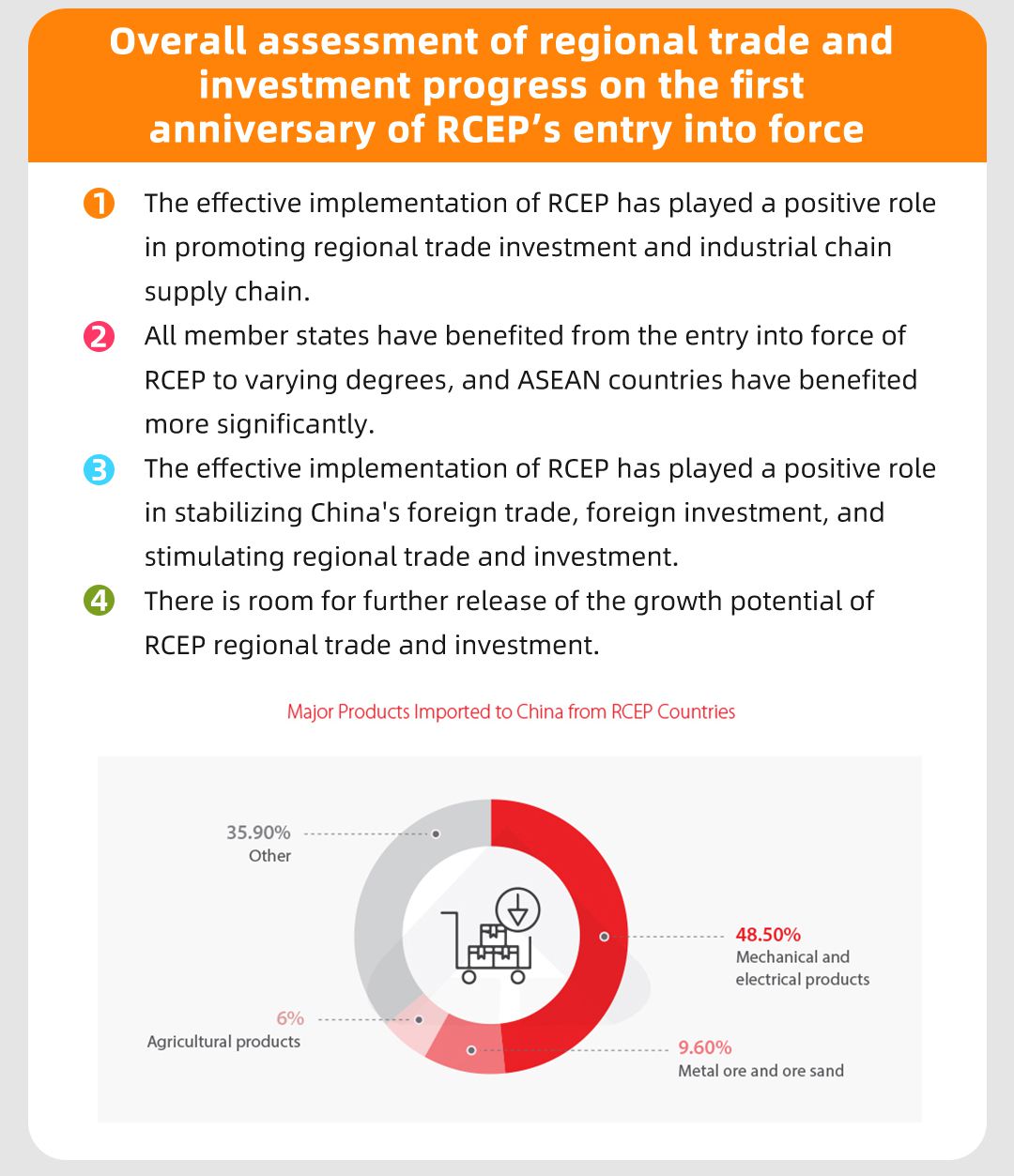

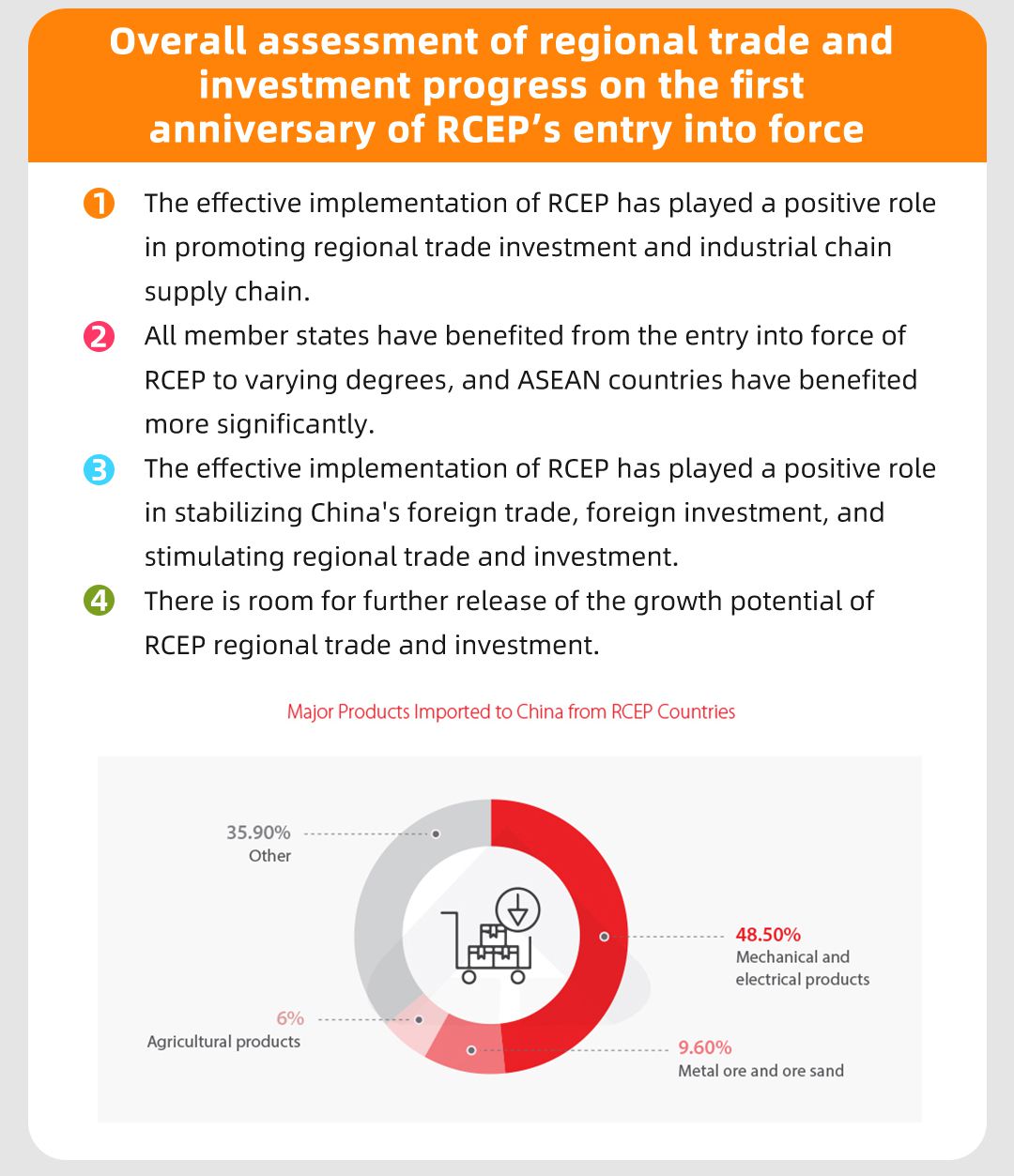

Overall Assessment of Regional Trade and Investment Progress on the First Anniversary of RCEP's Entry into Force

(1)The entry into force of RCEP has positively contributed to regional trade and investment and supply chains

From the member countries that have published annual trade data, the trade in intermediate goods has shown a steady growth in most member countries since the RCEP came into effect. China, as the world's top manufacturing country, continues to maintain stable trade in intermediate goods with the RCEP region.

(2)All member countries have benefited to varying degrees from the entry into force of the RCEP, with more obvious benefits for ASEAN countries

After the signing of RCEP in 2020, many research institutions have used economic models to predict the effects of the RCEP after its entry into force, and many of these studies believe that China, Japan and South Korea will benefit the most from it, while some of them believe that the benefits for ASEAN countries may not be obvious.

Looking at the trade and investment development of RCEP member countries, one year after the RCEP came into effect, most ASEAN member countries have performed better than China, Japan and Korea, which to some extent indicates that ASEAN countries have benefited more obviously.

(3)The effective implementation of RCEP has played a positive role in stabilizing China's foreign trade and foreign investment and boosting regional trade and investment

From the data of China's trade in goods, utilization of foreign investment and outbound investment with other RCEP member countries in 2022, the overall growth rate is relatively fast, and the pulling rate and contribution rate to China's overall trade and investment is more prominent.

(4)RCEP regional trade and investment growth potential has room for further release

In 2021, the total intra-regional trade of RCEP accounts for 44.1% of the total foreign trade of RCEP, which is much higher than the 22.5% of the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), but lower than the 57.8% of the EU, and there is still much room for improvement.

Reasons affecting the performance of regional trade and investment after the entry into force of RCEP

To sum up, the entry into force of RCEP has had a positive impact on regional trade and investment, and there is room for further growth. In order to fully exploit the dividends of RCEP on regional trade and investment and economic growth, it is necessary to further explore the specific reasons affecting the performance of regional trade and investment after the entry into force of RCEP in 2022.

(1) Theoretical level: FTAs have a positive impact on trade and investment, but there is a general lag and heterogeneity

From the traditional theory of economics, most scholars agree that FTAs have positive effects on trade and investment, but also point out that the mechanisms and channels through which FTAs affect trade and investment are more complex.

In terms of static effects, the impact of FTAs on trade flows is mainly transmitted through the mechanisms of trade creation effect, trade diversion effect, trade expansion effect and trade deflection effect.

In terms of dynamic effects, FTAs can not only have an impact on trade and investment through mechanisms such as investment creation effect, investment transfer effect, competition effect and reform effect, but also have a positive impact on trade and investment through market scale effect.

(2) Foundation level: existing FTAs have reduced the RCEP

The marginal effects of the initial implementation of RCEP, CPTPP, NAFTA and other regional FTAs consisting of multiple members, many of which have already established bilateral free trade ties among regional members before they come into effect, may reduce the marginal effects of the new broader FTAs to a certain extent, making their stimulating effects on trade and investment growth in the initial implementation not The stimulus to trade and investment growth in the early stages of implementation will not be significant.

Considering the underlying factors of the above bilateral FTAs, for China, the direct impact of RCEP on trade in goods will mainly come from the tariff reduction between China and Japan and the additional tariff reduction commitments between China and Korea and ASEAN.

Therefore, the scope of RCEP zero-tariff preferential products between China and Japan in 2022 is still limited, with most products having a tariff reduction period of more than ten years, and the positive impact will take longer to be fully released.

(3) Micro-level: enterprises need time cost and adjustment cost to enjoy the new FTA

First, enterprises need some learning and practical exploration time to take advantage of the new FTA.

Secondly, in order to enjoy the benefits of the FTA, enterprises need to adjust their product development, production and marketing, which not only takes time, but also may generate adjustment costs, which in turn affects the effect of the FTA on trade and investment.

Finally,Enterprises using RCEP also face difficulties.

First, there is still room for further improvement of the existing RCEP certificate of origin rules and procedures. Second, the convenience of using RCEP certificate of origin in some member countries needs to be strengthened. Third, the problem of mutual recognition of rules and standards leads to difficulties for enterprises to enjoy benefits.

(4) Macro-level: multiple factors overlap to bring complex impact on intra-regional trade and investment

Since 2022, the RCEP region has faced the overlapping effects of various macro factors such as the new crown epidemic, inflation, exchange rate fluctuations, as well as geopolitics and economic security, which have had a complex impact on trade and investment in the RCEP region.

Insights and Suggestions

(1)Objectively assess and view the effects of the entry into force of RCEP

First, while paying attention to the short-term effects of RCEP, we should pay more attention to the long-term effects and dynamic effects of RCEP.

Second, while focusing on the benefits of RCEP members, it is more important to see the creative and spillover effects brought by RCEP.

Third, we should see the complexity of the RCEP's impact mechanism on trade and investment, and the effect of its implementation is disturbed by external factors.

(2)Further release the potential of RCEP regional trade and investment cooperation

First, the RCEP will be implemented with high quality, making full use of the RCEP Joint Committee and its four sub-committees to strengthen coordination and supervision on the implementation of the RCEP and fully implement the liberalization commitments under the RCEP framework.

Second, we will jointly build an open and modernized international cooperation network for industrial chain supply chain. Under the framework of RCEP, we will focus on using regional rules of origin accumulation to provide more convenience and support for enterprises to strengthen regional supply chain cooperation in industrial chains.

Third, to promote the construction of higher-level FTAs to provide better institutional safeguards for RCEP regional trade and investment cooperation.

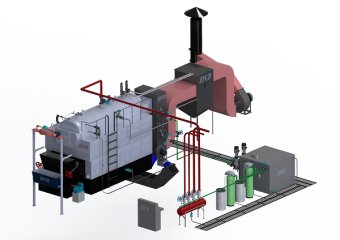

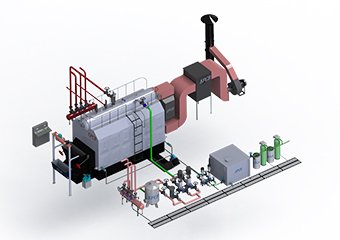

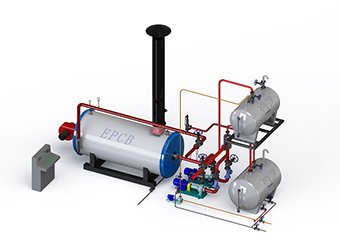

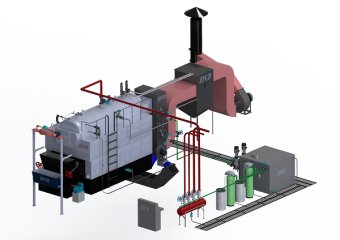

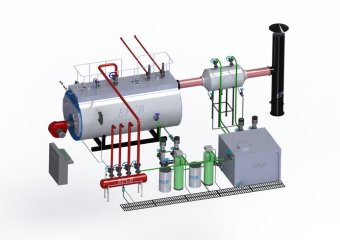

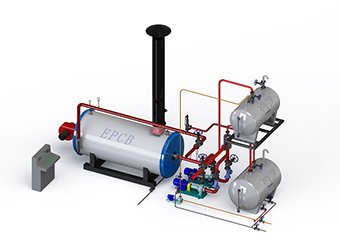

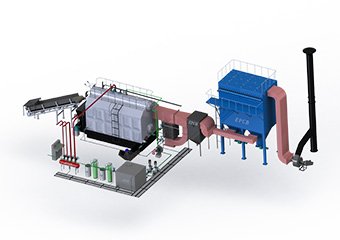

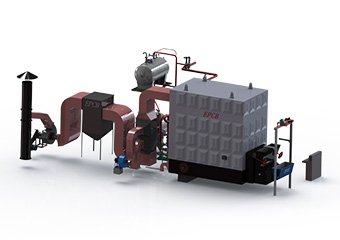

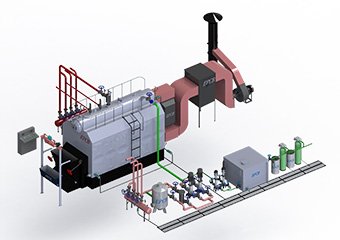

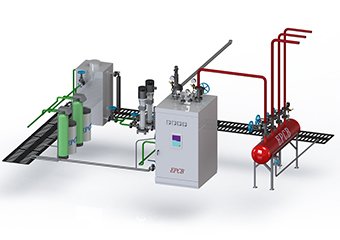

Steam Boiler

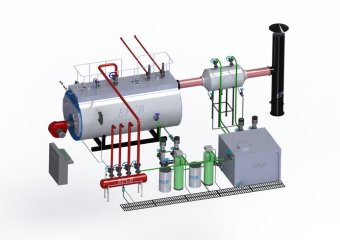

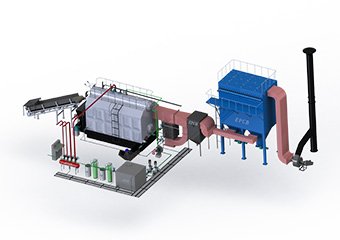

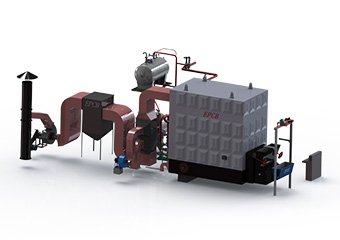

Steam Boiler Thermal Oil Boiler

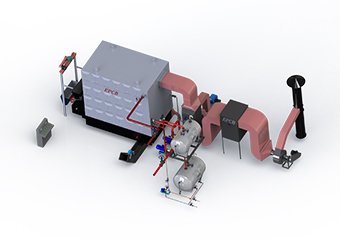

Thermal Oil Boiler Hot Water Boiler

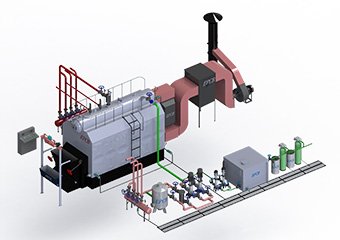

Hot Water Boiler Steam Boiler

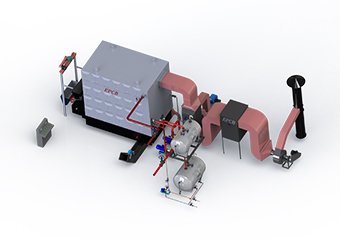

Steam Boiler Thermal Oil Boiler

Thermal Oil Boiler Hot Water Boiler

Hot Water Boiler Steam Boiler

Steam Boiler Thermal Oil Boiler

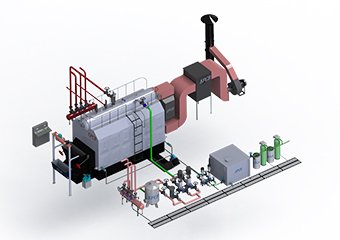

Thermal Oil Boiler Hot Water Boiler

Hot Water Boiler Steam Boiler

Steam Boiler Hot Water Boiler

Hot Water Boiler